Levy Explained

LEVY EXPLAINED

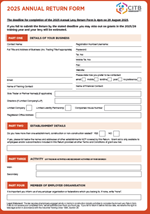

Completing your Levy Return

.jpeg.aspx?width=200&height=133)

CITB NI makes available the

Annual Levy Return in early April each year to CITB NI registered employers. The form

must be completed

and returned by the deadline stated on the Return

whether it is below the levy threshold or not.

CITB NI no longer issue hard copy Returns due to the expense of printing and postage, so please log onto our Portal to complete your Return and submit prior to the deadline.

A PDF version will also be available to download from our website www.citbni.org.uk. The completed Return can then be emailed to CITB NI Levy Team at levy@citbni.org.uk prior to the deadline.

CITB NI issues weekly reminders for receipt of the completed Return by text & email and a posted reminder is issued in mid-August.

Only those who have not made a Return will receive a reminder notification.

Useful tips on completing your Annual Return Form (please click for more info)

Submitting your Annual Levy Return form:

-

If you complete the online form you can submit the form and it will upload to CITB NI. CITB NI has listened to industrys needs and has extended the Online Return submission period. You will be able to complete the 2025 Annual Return form online from 7 April 2025 until 4pm on 29 August 2025.

-

-

If you complete the PDF version of the form, you can:

-

-

* Post the form using the correct postage rate and allowing sufficient time for delivery

-

* Email the form using a read receipt to levy@citbni.org.uk

-

CITB NI would encourage you to complete the online form which holds a history of previously completed forms and allows for you to download a completed copy for your own records.

CITB NI will not be held responsible for any Return which is not received fully completed by CITB NI by the deadline. If you are in any doubt about the Return having been received by CITB NI, please contact

028 9082 5466 for confirmation,

prior to the deadline.

Employers will have a limited time to complete the Return online, after which it will be removed. Available grant aid and CITB NI benefits will be restricted for any Return received after the specified deadlines.

Employers who fail to complete the Annual Return Form and/or Option Return Form/s by the specified deadline/s will be unable to claim grant aid from CITB NI for the WHOLE training year (i.e. September to August).

Employers will also receive an ESTIMATED invoice if they fail to complete the levy Return form by the deadline specified.

Legal Statement

The law requires all employers engaged wholly or mainly in construction industry activities to complete the Annual Levy Return form. If we do not receive your completed form, we will estimate how much you must pay. If you fail to return it before the due date, we reserve the right to take legal action in accordance with the Industrial Training Order 1984, Section 28.

Download the related documents below

|

Annual Return Form 2025 |

Annual Return 2024 |

Annual Return Form 2023 |

Direct Debit Mandate |

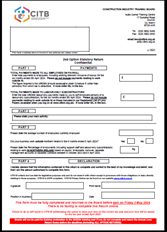

2nd option Form |

|

.png.aspx?width=150&height=207) |

.png.aspx?width=150&height=210) |

|

|